PARTNER CONTENT by FEDERATED HERMES LIMITED

This content was paid for and produced by FEDERATED HERMES LIMITED

In our view, it is imperative that all investee companies generate a positive impact that can be measured quantitatively, as well as qualitatively. As such, we invested considerable time and resource in the second half of 2020 to create our proprietary Impact Database, which enables us to quantify the impact of companies held within our portfolio. The Database also provides a clear framework for us to assess companies on our watchlist.

Why?

After looking at the tools available in the market to analyse impact data, we did not believe that any one provider had the depth of understanding and granularity we required at a company level. Indeed, the majority of pre-existing tools used aggregate modelling and artificial intelligence (AI) insights that, while impressive, at times yielded inaccurate and incomplete results for individual companies.

Building the Impact Database1

In building our database, we have used traditional equity research methods, in combination with impact modelling techniques. As well as leveraging our expertise as impact investors at the international business of Federated Hermes, we used an external consultant to help aggregate data from company, sector and impact industry reports.

Reporting our portfolio’s impact

We have carefully chosen 20 impact metrics, which have been grouped into 11 relevant themes. They are used to capture the impact of all the companies in which we invest. Some themes may include solutions and operations-based metrics, such as Climate Change which looks at both operations metrics for carbon emissions and solutions metrics for emissions avoided; whereas Gender Equality currently only contains operations based metrics. Nevertheless, all portfolio companies are assessed using at least one solutions-based metric and one operations-based metric.

Assessing the impact of companies at such a granular level with quantifiable outcomes allows us to achieve two important objectives. First, it allows us as investors to trace and account for each investment, providing a means through which we can monitor a company and ensure its impact intentionality as a business. Secondly, it provides our clients with a quantifiable indication of how their capital allocation is helping achieve positive impact, as aligned to the 17 UN Sustainable Development Goals. The end result means we are able to report to our clients on the overall impact of our portfolio, as well as the impact of individual holdings.

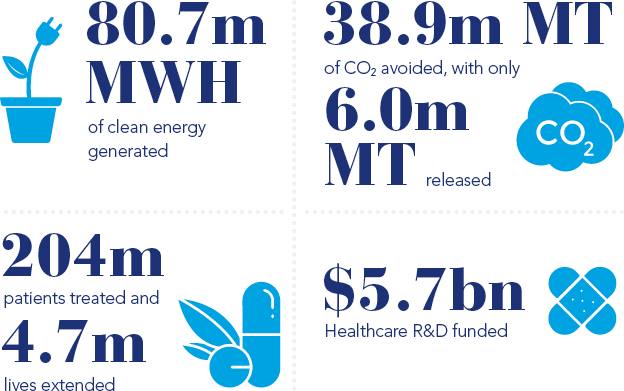

Total company level impact of stocks held, 2019 highlights2

Using our proprietary Federated Hermes Impact Database, we are able to present our impact data on an aggregated, cross company basis. Put simply, it depicts our estimation of the total impact that the companies in which we are invested have delivered in 2019.

Highlights include:

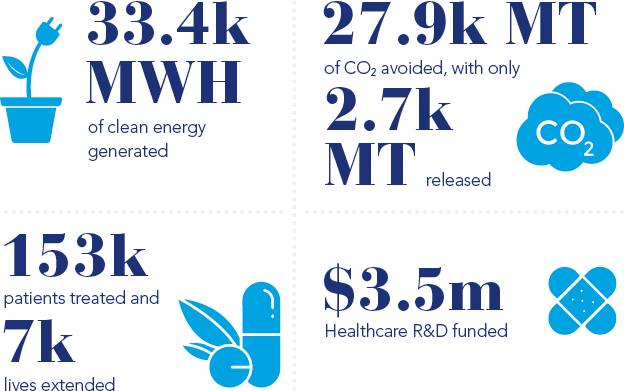

Impact achieved by capital deployed

As well as producing company-level impact, our database allows us to report on the impact of our Fund’s assets under management. Put simply, we scale the metrics to demonstrate the impact accomplished through the capital we deploy – approximately $450m as at 31 December 2020 – on behalf of our clients, thereby reflecting our ownership of each company held in our Fund.

Highlights include:

Source: Federated Hermes, as at 31 December 2019. Note: The Impact Opportunities portfolio has been harmonised for calendar year impact.

Read the full report here or visit the new Federated Hermes sustainability hub to access more in-depth analysis, research and commentary on sustainability, direct from our investment teams.

1 As it stands, the database calculates the impact our portfolio had in the calendar year 2019. We are in the process of rolling this analysis forward to calculate impact for the calendar year 2020, as each of our investee companies start to publish their annual earnings and sustainability reports. We expect to be able to report to clients on the 2020 impact of our portfolio by the end of June.

2 Once each of our investee companies publish their annual earnings and sustainability reports, we will be able to update our figures to reflect 2020.

The value of investments and income from them may go down as well as up, and you may not get back the original amount invested. Past performance is not a reliable indicator of future results.

For professional investors only. This is a marketing communication. This document does not constitute a solicitation or offer to any person to buy or sell any related securities, financial instruments or products; nor does it constitute an offer to purchase securities to any person in the United States or to any US Person as such term is defined under the US Securities Exchange Act of 1933. It pays no regard to an individual’s investment objectives or financial needs of any recipient. No action should be taken or omitted to be taken based on this document. Tax treatment depends on personal circumstances and may change. This document is not advice on legal, taxation or investment matters so investors must rely on their own examination of such matters or seek advice. Before making any investment (new or continuous), please consult a professional and/or investment adviser as to its suitability. All figures, unless otherwise indicated, are sourced from Federated Hermes. All performance includes reinvestment of dividends and other earnings.

Federated Hermes Investment Funds plc (“FHIF”) is an open-ended investment company with variable capital and with segregated liability between its sub-funds (each, a “Fund”). FHIF is incorporated in Ireland and authorised by the Central Bank of Ireland (“CBI”). FHIF appoints Hermes Fund Managers Ireland Limited (“HFMIL”) as its management company. HFMIL is authorised and regulated by the CBI. Further information on investment products and any associated risks can be found in the relevant Fund’s Key Investor Information Document (“KIID”), the prospectus and any supplements, the articles of association and the annual and semi-annual reports. In the case of any inconsistency between the descriptions or terms in this document and the prospectus, the prospectus shall prevail. These documents are available free of charge (i) at the office of the Administrator, Northern Trust International Fund Administration Services (Ireland) Limited, Georges Court, 54- 62 Townsend Street, Dublin 2, Ireland. Tel (+ 353) 1 434 5002 / Fax (+ 353) 1 531 8595; (ii) at https://www.hermes-investment.com/ie/; (iii) at the office of its representative in Switzerland (ACOLIN Fund Services AG, Leutschenbachstrasse 50, CH-8050 Zurich www.acolin.ch). The paying agent in Switzerland is NPB Neue Privat Bank AG, Limmatquai 1/am Bellevue, P.O. Box, CH-8024 Zurich.

Issued and approved by Hermes Fund Managers Ireland Limited (“HFMIL”) which is authorised and regulated by the Central Bank of Ireland. Registered address: The Wilde, 53 Merrion Square, Dublin 2, Ireland. HFMIL appoints Hermes Investment Management Limited (“HIML”) to undertake distribution activities in respect of the Fund in certain jurisdictions. HIML is authorised and regulated by the Financial Conduct Authority. Registered address: Sixth Floor, 150 Cheapside, London EC2V 6ET. Telephone calls will be recorded for training and monitoring purposes. Potential investors in the United Kingdom are advised that compensation may not be available under the United Kingdom Financial Services Compensation Scheme.

Find out more

Related Content

.jpg%3Fv1?source=ftadviser&width=296)